It’s not new to reflect on the changes that digital platforms (and open access to them) have had for opening markets up to consumers, resulting in a busy and competitive landscape for many sectors.

However, recent events (dare I mention the C word?) have affected consumer dynamics and these reactive behaviors are now set to shape how brands engage with customers in the future; in other words the much-used phrase “the new normal”.

How has the pandemic caused a reset arising from consumer behavior changes?

From the peaks of “panic buying” which threw out demand models, bundling and pricing strategies to the more cautious heightened price sensitivity arising from economic security; the supply chain is having to make rapid adjustments to their offering to remain relevant.

During the various stages of lockdown, we have all turned to online platforms to support our purchasing, entertainment and socialization needs. The customer journey has become more focused online with digital platforms proportionately squeezing the physical part out (where we previously saw a mixture of both). Omni-channel is still here to stay, don’t shoot the messenger, this is about nuance!

With this increase in online use, comes a decrease in controlling or affecting the traditional customer journey, think about price sensitivity as an example. If a customer is in one physical store carrying out their shop, it is less likely they will walk to another store if that shop is 20 cents more expensive on a specific product. However online, it is easier to see a detailed shopping basket with pricing on separate tabs online and choose the most cost-effective option.

High digital engagement + more competition + price sensitivity = Less control. (My math teacher would have a field day with that!)

That leads me to how much we can rely on brand loyalty, another key area of customer experience. During the pandemic, brand loyalty was high at the beginning as the trust factor came into play. But many online retailers and grocers who became overwhelmed with demand saw some customers walk away to another supplier if they had difficulty getting a delivery slot or if items were out of stock. There’s the lack of control again.

Customers still expect businesses to work hard despite restrictions. In this Retail Media survey “Eighty percent of shoppers agreed that the restrictions on quantities put in place by many grocers during lockdown was justified, but only 18% agreed that the absence of offers/promotions was necessary.”

If we go back to school for a moment, both Maslow’s Hierarchy of Needs (perhaps consumers have taken a step down a level as to what they expect) and the 4Ps (pricing, promotion, product and place) remain relevant. It is just how organizations adapt as to their success.

In McKinsey’s recent insight paper “Pricing in a pandemic: Navigating the COVID-19 crisis” they recommend “building in flexibility in pricing”. It’s worth surfacing a quote in full:

“The outperformers in today’s environment will address customers’ short-term pain points without needlessly destroying long-term value. For many companies, this will mean providing temporary pricing or volume relief. Rather than lock in long-term, highly discounted arrangements that might impact the business in the recovery, they will explore ways to unbundle offerings, offer one-time promotions, flexible payment terms, credit for future purchases, or other techniques that align the offer or pricing architecture to near-term needs while providing flexibility for the future.”

It is clear that having a clear and flexible pricing strategy is essential. But how can you ensure that you have the insight available in order to plan and react quickly in the new normal?

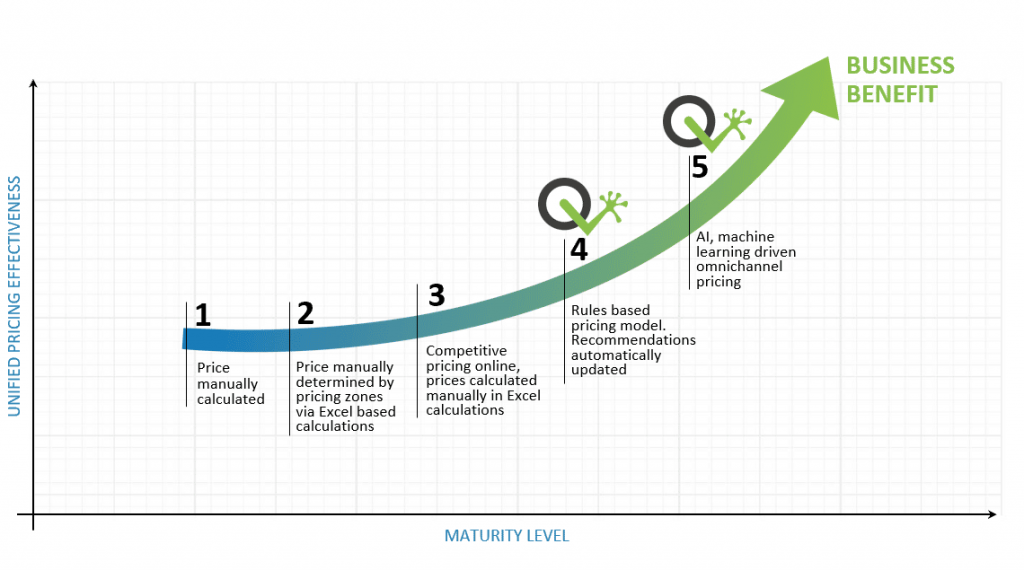

Dynamic pricing and how it supports your business process

I talked about the fluctuations that have brought pricing to mind, and these customer behaviors and reactions to macro-economics is here to stay. The proliferation of competitors, the changing needs all point to the requirement of knowing what competitors are offering, what customers expect and how brands can meet it all.

Today, pricing managers manually analyze multiple data sources to support their pricing decisions for only 5%-15% of their catalog.

Dynamic pricing (aka surge pricing, demand pricing, or time-based pricing) is where businesses set flexible prices for products or services based on current market demands. Getting to this insight is key.

Part of the Prodware Innovation Center, QuickLizard is a real-time dynamic pricing management platform used by e-commerce and omni-channel retailers and distributors.

The innovative part is that it uses Artificial Intelligence to continuously track and analyze multiple data sources to adjust prices so businesses can adjust pricing, stay competitive and profitable. Real-time market trends are collected from customer demand, customer journeys and the competitive landscape.

Prodware have built a connector into Microsoft Dynamics 365 Finance and Operations to integrate with our customers’ own ERP and sales data to sync pricing recommendations. I’m here to help our customers inject such innovation into their strategies and processes to navigate the new normal.