AI is transforming ERP finance, streamlining budgeting and reshaping financial management. It’s no longer optional—companies need it to stay ahead in today’s fast-paced financial world.

What’s the big deal about AI in ERP finance? AI is boosting core financial processes like accounting, reporting, risk assessment, and fraud detection. It also aids decision-making, optimizes working capital, and enhances overall financial performance. Let’s explore how this tech is reshaping the future of ERP finance.

Automating Core Financial Processes

AI is revolutionizing core financial processes like accounts payable (AP) and accounts receivable (AR). By incorporating AI into ERP systems, businesses can streamline these critical functions, enhance cash flow management, and reduce manual errors.

Streamlining Accounts Payable and Receivable

AI-powered tools automate invoice processing, data extraction, and payment reconciliation. Optical Character Recognition (OCR) combined with machine learning eliminates manual data entry by automatically scanning and processing invoices. Natural Language Processing (NLP) analyzes correspondence to update payment status. These technologies speed up invoice processing, reduce human errors, and provide an additional layer of protection against fraudulent invoices.

Intelligent Cash Flow Management

Predictive analytics in AI-enabled ERP systems analyze historical payment data to forecast customer payment behavior. By assigning labels like ‘fast payer,’ ‘slow payer,’ or ‘at-risk payer,’ businesses can proactively manage accounts and optimize cash flow. AI also offers prescriptive guidance, recommending actions that yield the best results based on market context and benchmarking data.

| AI technology | Impact on cash flow management |

| Predictive Analytics | Forecasts customer payment behavior |

| Prescriptive AI | Recommends optimal actions |

| NLP | Automates payment status updates |

Reducing Manual Data Entry Errors

Manual data entry is error-prone, leading to discrepancies and operational issues. AI minimizes these risks by automating data extraction and processing. For example, AI can generate AR and AP reports, answer general questions, and even draft emails summarizing due amounts with payment links. By reducing manual intervention, AI ensures data integrity and reliability.

Embracing AI in AP and AR processes is crucial for businesses looking to optimize cash flow and drive growth. As AI continues to advance, we can expect further innovations in ERP technology, transforming financial management for organizations worldwide.

Enhanced Risk Management and Fraud Detection

With AI, risk management and fraud detection are on a whole new level. By leveraging advanced algorithms and machine learning techniques, ERP systems can now proactively identify potential threats and mitigate them before they cause significant damage.

One key area where AI is making a big impact is credit risk assessment. AI-powered tools can analyze vast amounts of data, including financial statements, credit reports, and market trends, to accurately predict the likelihood of default. This allows finance teams to make more informed decisions when extending credit and setting credit limits.

| AI Technology | Impact on Credit Risk Assessment |

| Machine Learning | Analyzes historical data to predict default risk |

| Natural Language Processing | Extracts insights from unstructured data like news articles |

| Predictive Analytics | Forecasts future credit performance based on patterns |

But AI isn’t just about assessing risk – it’s also a powerful weapon in the fight against fraud. Real-time fraud detection algorithms can monitor transactions as they happen, flagging suspicious activity for further investigation. By learning from past fraud cases, these algorithms can adapt to new threats and stay one step ahead of fraudsters.

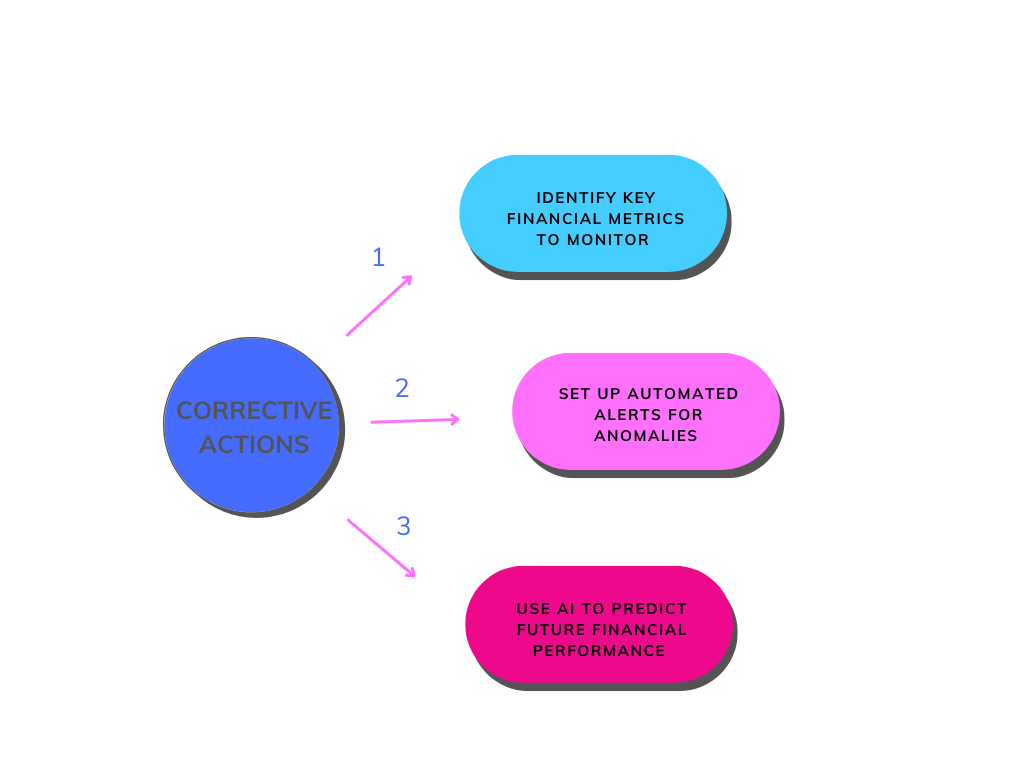

AI is also enabling proactive financial health monitoring. By continuously analyzing a company’s financial data, AI can spot early warning signs of financial distress, such as declining cash flow or increasing debt levels. This allows finance teams to take corrective action before problems escalate:

The bottom line? AI is giving finance teams superpowers when it comes to managing risk and detecting fraud. By harnessing the power of data and advanced analytics, ERP systems can help organizations stay financially healthy and secure in an increasingly complex world.

AI-Driven Decision Support for Finance Teams

AI is stepping up the game in financial decision-making, providing finance teams with powerful tools to optimize planning, budgeting, and forecasting. By leveraging advanced analytics and machine learning algorithms, AI-driven solutions offer personalized insights and recommendations, enabling finance professionals to make data-driven decisions with confidence.

Intelligent Financial Planning and Budgeting

By analyzing vast amounts of historical data, market trends, and external factors, AI algorithms can generate accurate and dynamic financial plans. These intelligent systems can continuously update budgets based on real-time performance and changing market conditions, ensuring that financial targets remain achievable and aligned with business objectives.

For instance, AI-powered tools can automatically adjust budget allocations based on actual spending patterns, identifying areas of overspending or underspending. This proactive approach helps finance teams optimize resource allocation and make informed decisions to drive financial efficiency.

Scenario Analysis and Forecasting

One of the most significant advantages of AI in financial decision support is its ability to perform advanced scenario analysis and forecasting. AI algorithms can simulate multiple “what-if” scenarios, considering a wide range of variables and their potential impact on financial outcomes. Finance teams can therefore assess the viability of different strategies and make well-informed decisions.

| Scenario | Description | AI-Driven Insights |

| Market Volatility | Analyzing the impact of market fluctuations on financial performance | AI algorithms can predict potential risks and recommend strategies to mitigate them |

| Expansion Plans | Evaluating the financial feasibility of expanding into new markets or product lines | AI can forecast revenue potential, cost implications, and ROI for different expansion scenarios |

| Cost Optimization | Identifying opportunities to reduce costs without compromising quality or efficiency | AI can analyze spending patterns, identify inefficiencies, and suggest cost-saving measures |

Personalized Insights for Financial Executives

AI goes beyond number-crunching, delivering personalized insights to financial executives by analyzing preferences, past decisions, and contextual data. AI-powered dashboards highlight key KPIs, enabling faster, smarter decisions and letting leaders focus on strategy. It also enhances collaboration by centralizing data and insights, fostering a data-driven culture. As AI evolves, its role in ERP finance will be critical for driving growth and smarter financial management.

Optimizing Working Capital with AI

AI is revolutionizing how businesses manage their working capital, offering innovative solutions to age-old challenges. By leveraging the power of data and advanced analytics, AI-driven systems are transforming inventory management and supplier relationships, ultimately optimizing working capital.

Smart Inventory Management

Another key area where AI is making a significant impact is inventory management. AI algorithms can analyze vast amounts of data, including historical sales patterns, market trends, and supplier lead times, to generate accurate demand forecasts. With this predictive capability, businesses are able to maintain optimal inventory levels, reducing the risk of stockouts while minimizing excess inventory holding costs.

Moreover, AI can automate inventory replenishment processes, ensuring that the right products are ordered at the right time. By continuously monitoring inventory levels and sales trends, AI systems can trigger reorder points based on predefined thresholds, streamlining the procurement process and reducing manual intervention.

| AI Technology | Impact on Inventory Management |

| Predictive Analytics | Accurate demand forecasting and optimal inventory levels |

| Automated Replenishment | Streamlined procurement and reduced manual intervention |

| Real-time Monitoring | Proactive decision-making and improved inventory visibility |

AI-Powered Supplier Management

AI is transforming supplier management and working capital by analyzing performance data to identify reliable, cost-effective suppliers. It supports smarter supplier selection, negotiation, and risk reduction, while AI-powered invoice processing and payment automation streamline accounts payable, cut errors, and improve cash flow. By leveraging data and advanced analytics, businesses can optimize working capital, strengthen supplier relationships, and boost overall financial efficiency. As AI evolves, it will continue to reshape how companies manage working capital in the digital age.

Conclusion

The rise of AI in ERP finance has brought about a major shift in how businesses handle their budgets.

And as we look ahead, it’s clear that AI will keep shaking things up in the finance world. For companies looking to stay competitive, embracing AI in their ERP systems isn’t just a nice-to-have anymore – it’s becoming a must. With AI’s help, companies can make smarter choices, cut down on risks, and boost their overall financial health. The future of finance is here, and it’s powered by AI.