Dematerialization (and going paperless) is a strategic subject for all companies, to increase speed, accuracy and to reduce the materials needed to transact bookkeeping activities.

Going paperless is part of many organizations’ CSR policies as business drives activities to “do more with less” and reduce the environmental impact on the planet. This movement historically has arisen from a mixture of voluntary and mandatory initiatives.

One such area is the exchange and import of supplier invoices.

Legislation across Europe for electronic invoicing

In France, a new regulation will be in force in 2024, from 1 July the electronic invoicing between companies changes dimension:

- Issuing electronic invoices will gradually become mandatory for all companies between July 2024 and January 2026, depending on company size

- Therefore, from 1 July 2024 all companies are likely to receive and will be obliged to accept, electronic invoices

This follows on from an EU-wide directive to introduce a European Standard for eInvoicing in response to the many eInvoice formats used across the EU. These varied formats cause unnecessary complexity and high costs for businesses and public entities.

In France each year there are two billion B2B invoices issued, and it is estimated that only a quarter are electronic. The French government sees great potential in further streamlining of processes, simplification and of course recouping lost taxes. They state that for the business world itself, a saving of €4.5bn can be made through the widespread use of eInvoicing.

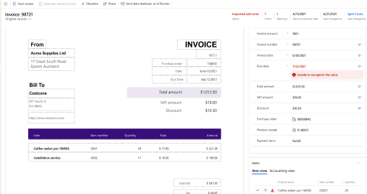

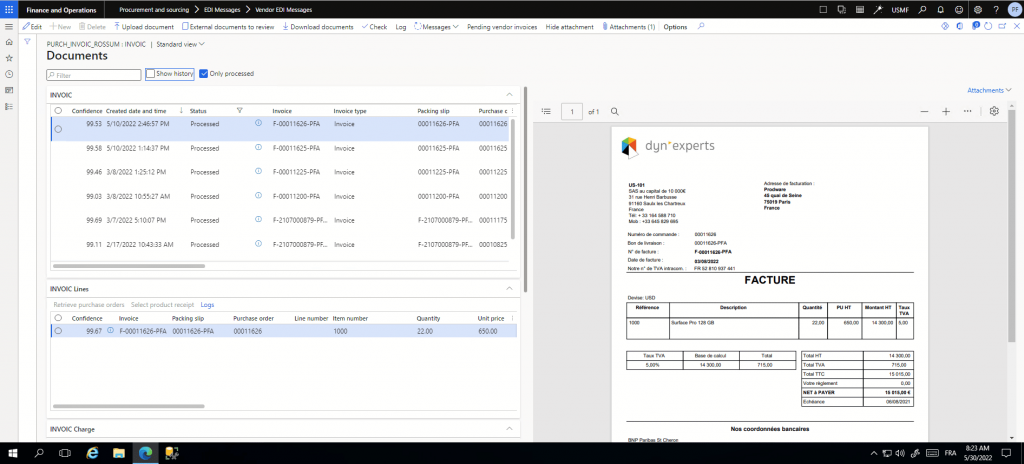

Microsoft response for OCR functionality in Dynamics 365 Finance

Microsoft has announced the launch of an OCR functionality available in public preview from July 2022.

Microsoft’s objective is to provide an optical character recognition (OCR) data processing with enough flexibility to fulfil multiple business needs of their customers.