The credit management and debt collection journey in Microsoft Dynamics 365 Finance and Operations so far

The ability to offer credit to customers is an important part of a business relationship. On the other hand, the supplier offering that credit must have in place clear processes to manage and collect the debt when it is due in order to balance risk.

In previous versions of Dynamics 365 Finance and Operations, users had a simple credit limit control. Because of this simplicity and limitation, my team developed a temporal credit in the Prodware Wholesale and Distribution solution, with this development our users can enter a sales order with a warning credit limit message and a blocking message on the validation flow (picking slip, packing slip and Invoice generation).

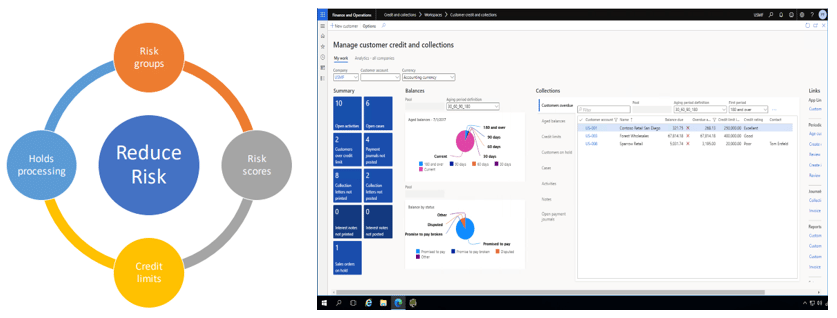

However, in the latest version, Microsoft offer a powerful credit management solution to reduce risk, they have covered the following areas:

- Created a risk group to aggregate multiple customers

- Added a risk score to evaluate with automatization rules

- Improved credit limits with new notions

- Improved holds processing based on multiple credit rules

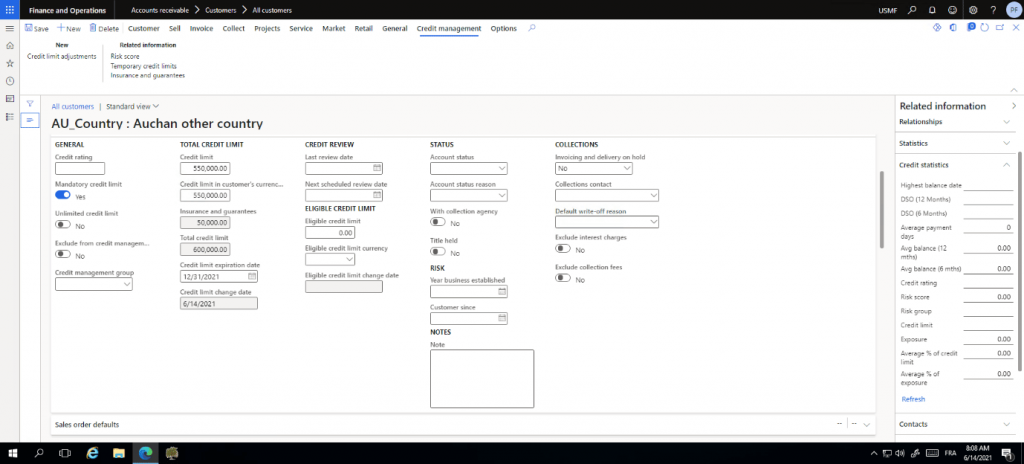

Enrichment of the customer record

Users can define the credit limit in transaction currency and accounting currency. Microsoft added a temporary credit limit update and insurance. So now users can define an expiration and update date for credit limits.

To manage risk calculations, Microsoft features manage the creation and first order dates.

The customer form now has some related information with credit statistics and organizations can share credit within a customer group.

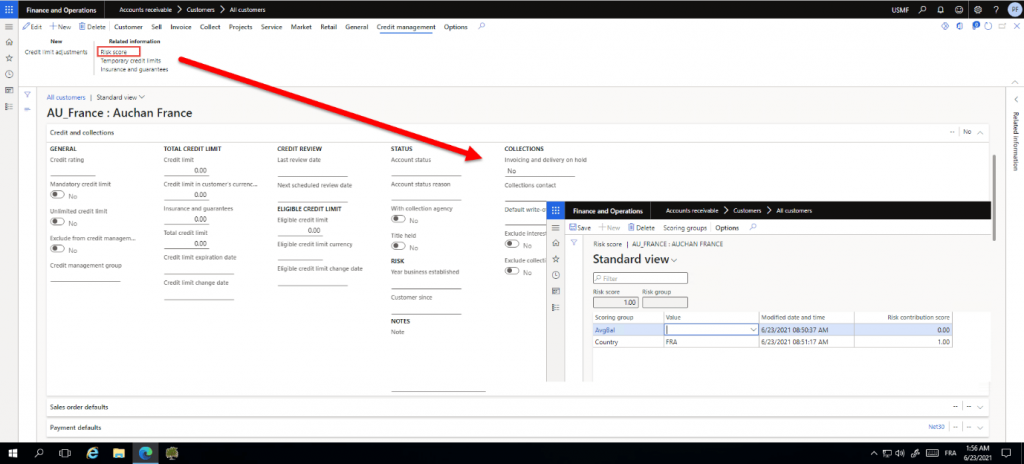

Risk scores to measure the amount of risk associated with a customer

Customer risk is essential to credit management. Microsoft added elements that help users define the risk of a customer: how many years have they been in business, what year were they established and how long have they been our customer.

There are optional risk scores. This option allows users to automatically calculate credit limit with different risk criteria.

After the customers are assessed against each of the risk attributes, the system calculates a score. This score is used to define a risk group. Finally, the risk group can be used as filters in blocking rules or to calculate automatic credit limits. This solution is very efficient when the financial customer situation is fluctuating.

Customer sales order, blocking rules, hold and release in the flow

The Microsoft Dynamics 365 system suggests placing orders on hold automatically with complex rules. Users have different criteria to define these rules, i.e. Days overdue, Amount overdue, Terms of payment, Credit limit expired, Account status, Sales order amount (with one exclusion that overrides all others), Credit limit used, Change in payment terms, and Change in discounts. As you know, you can construct a complex combination to hold orders.

The customer sales orders can be held in the order and invoice process (Confirmation, picking list, Release to warehouse, Packing slip, and Invoice). Orders are placed on hold if the blocking rules are triggered. But users can also force an on hold situation. You can release orders automatically with a periodic batch if the blocking reasons are changed (for example a payment being made).

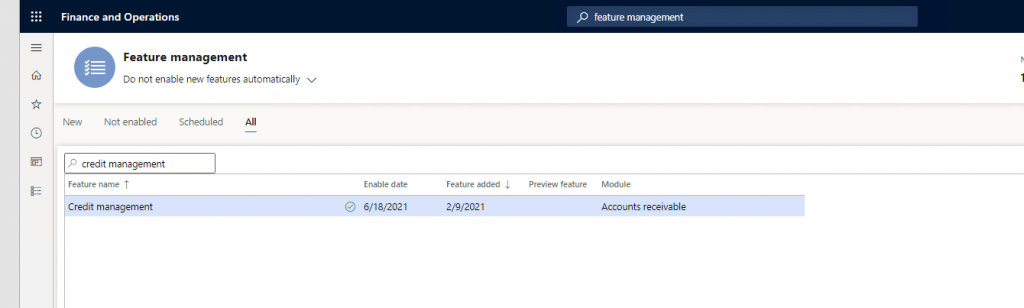

How to activate: Don’t forget to activate the functionality on the Microsoft Feature management screen.

I invite you to try it out and have some fun with it, does it meet your needs now in terms of balancing credit risk of your customers?

Originally published on LinkedIn